CLOSED SALES – There were1,501 closed sales in December of 2025, up 4.6% from December of of 2025

SALES PRICE – The median sales price closed out at $433,825| up+4.6% year-over-year, and the average sales price for November 2025 was$630,469 up+3.0%

PRICE PER SQFT – The average price per sqft for all residential property types was at $295 | up +1.4%

NEW WRITTEN SALES (Pending) – There were 1,181 new written sales in December 2025, up+16.2% This is an indicator of future activity and seems to be a good sign for 2026.

INVENTORY – Approximately 1,355 new listings (all property types) came online in December of 2025, which is upc+14.4% with the average Days on Market at 56, up +12% and 3.0 months of inventory.

NEW CONSTRUCTION

new construction comprises about 34% of the closed sales and represents 37% of all pending contracts in the MLS

- New Homes “pendings” will always be higher than new homes closings as new construction typically sits in pending status for far longer than a resale, and the new homes tend to “pile up” in pending status, so new homes actually represent about 34% of the sales market currently

- New homes represent 24% of the available inventory currently

- 14% of all closings in Charleston County are new construction

- 38% of all closings in Dorchester County are new construction

- 53% of all closings in Berkeley County are new construction

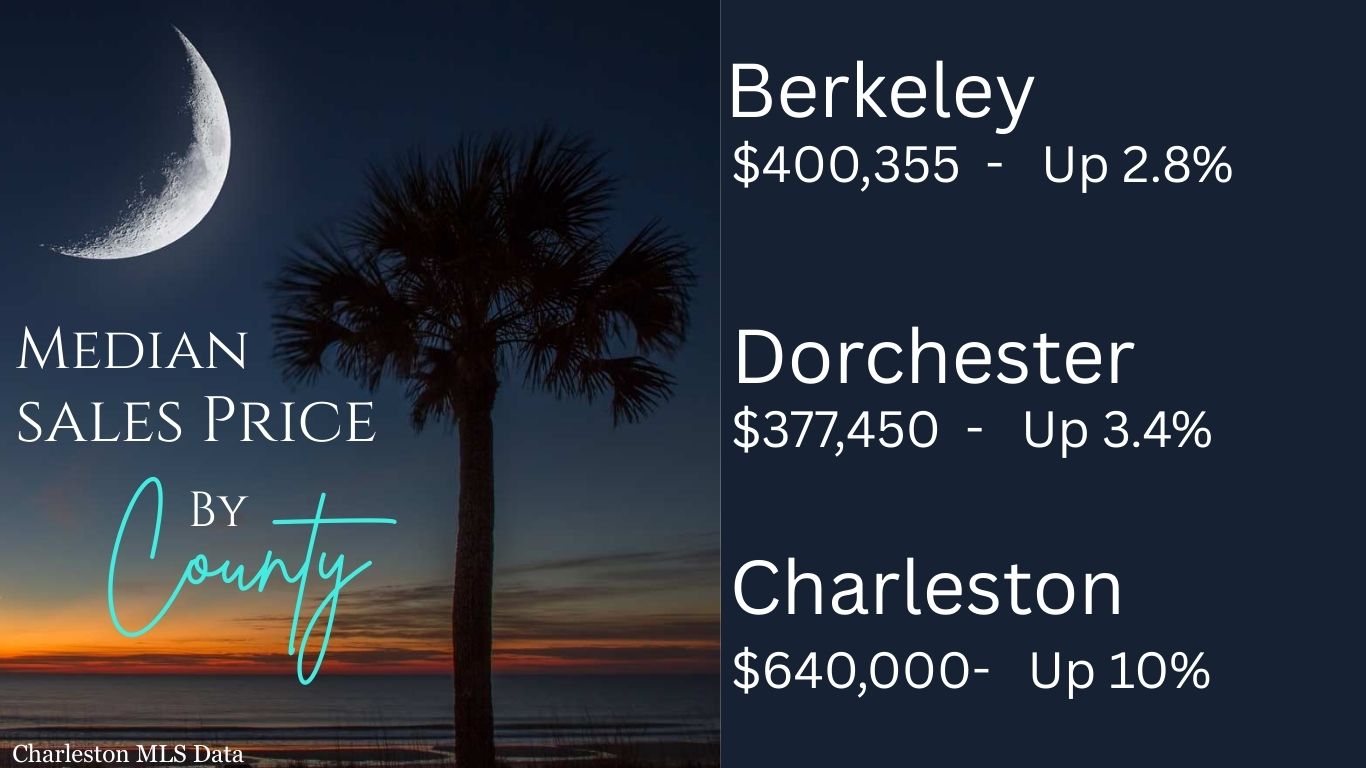

DECEMBER MEDIAN SALES PRICE BY COUNTY:

Year over Year – 2024 VS 2025

Nationally– Year Over Year – There was 3.0% decrease in pending home sales according to the National Association of Realtors. Regionally, there were gains in in the South and declines in the Northeast, Midwest, and West

Charleston MLS – 2025 Closed sales were at approximately 5,000 which was about the same as they were in 2024. New listing total for the year came in at 6,012, up just 1% from 2024 and the median sales price was up just 1.3 %.

The Takeaway: December 2025 saw some increases in closed sales, price, and inventory compared to December 2024, but the year-over-year comparison (2024/2025) was relatively flat, with 2025 statistics very similar to those of 2024. However, December 2025 experienced an impressive 16% increase in Pending Sales (new written sales/not closed), which is an indicator of future closed sales and could be a positive sign for 2026.